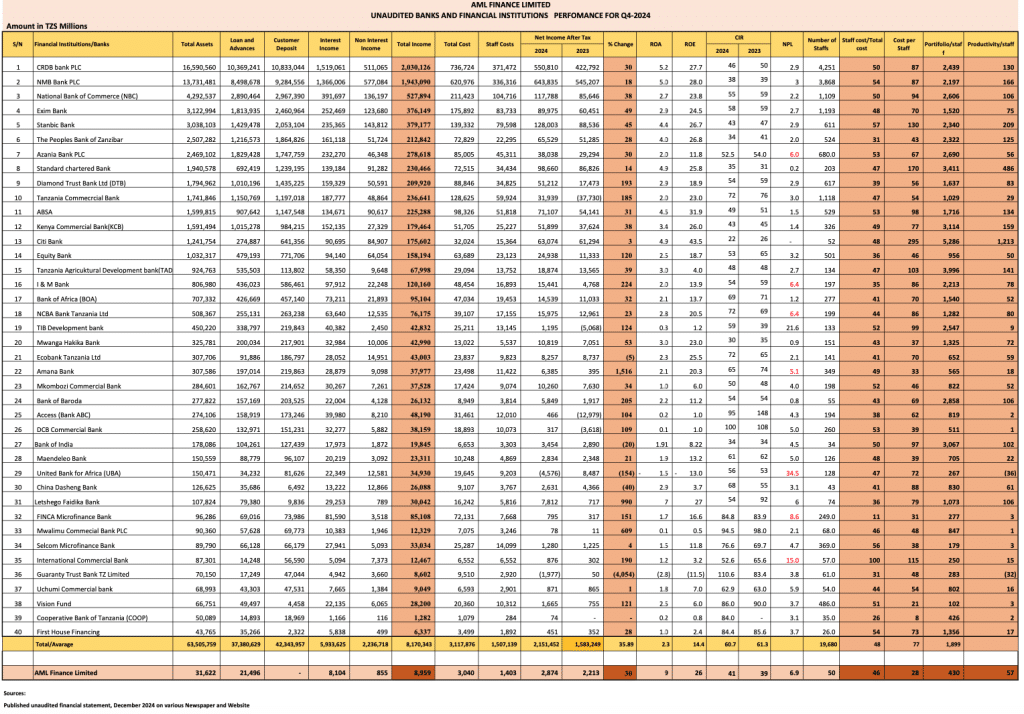

According to AML Finance’s Q4 2024 analysis, the Tanzanian banking sector demonstrated substantial growth in assets, revenue diversification, and deposit mobilization.

Total assets stood at TZS 63.51 trillion, with loans and advances amounting to TZS 37.38 trillion, making up 58% of total assets.

Customer deposits reached TZS 42.34 trillion. Despite these strong foundations, challenges persist in credit risk management and operational efficiency.

Financial Performance and Efficiency

Interest income remains the primary revenue source at TZS 5.93 trillion, complemented by non-interest income of TZS 2.24 trillion (38%), leading to a total income of TZS 8.17 trillion and a net income after tax of TZS 2.15 trillion.

The industry Return on Assets (ROA) was 2.3%, while the Return on Equity (ROE) stood at 14.4%.

The Cost-to-Income Ratio (CIR) was 60.7%, highlighting efficiency constraints within the sector.

Top-Performing Banks in 2024

CRDB Bank and NMB Bank dominate the sector, holding approximately 48% of total assets and 50% of total loans and advances. CRDB leads with total assets of TZS 16.59 trillion and loans of TZS 10.37 trillion, closely followed by NMB with total assets of TZS 13.73 trillion and loans of TZS 8.49 trillion. Their revenue dominance is evident, with CRDB reporting a total income of TZS 2.03 trillion and NMB at TZS 1.94 trillion, making the two of them cross the one-trillion mark in annual profits.

Conversely, some banks face financial struggles, including TIB Development Bank and Access Bank, which posted significant losses of TZS 5.07 billion and TZS 12.97 billion, respectively. These losses suggest inefficiencies in credit risk management and possible regulatory challenges affecting their profitability.

Citi Bank leads in efficiency, with an ROE of 43.5% and a CIR of 22%, while Access Bank and DCB Bank struggle with CIRs exceeding 95%, reflecting high operational costs, inadequate risk management and weak revenue generation.

Banks Facing Financial Challenges

Despite overall sector growth, some banks struggled with profitability and efficiency:

- TIB Development Bank and Access Bank recorded significant losses of TZS 5.07 billion and TZS 12.97 billion, respectively, reflecting credit risk and regulatory challenges.

- Access Bank and DCB Bank faced high CIRs exceeding 95%, highlighting operational inefficiencies and revenue generation weaknesses.

Tanzania’s Regional Banking Position

Tanzania’s banking assets represent 25.8% of its GDP, allowing further expansion.

In contrast, Kenya’s banking assets stand at 56% of its GDP, demonstrating higher financial inclusion. Kenya’s banking sector remains the largest in East Africa, with total assets of KES 8.2 trillion (TZS 141 trillion) and total loans of KES 4.8 trillion (TZS 82 trillion) which represents 58% of total assets similar to Tanzania.

Uganda and Rwanda have relatively smaller but stable banking industries: Uganda’s banking assets total UGX 51 trillion (TZS 30 trillion), while Rwanda’s stand at RWF 6.5 trillion (TZS 11 trillion).

Notably, Tanzania recorded the lowest Non-Performing Loan (NPL) ratio in East Africa at 5.0%, outperforming Kenya (13.2%), Uganda (8.7%), and Rwanda (6.9%).

However, Kenya outperforms Tanzania in profitability and efficiency, with an ROA of 3.5%, ROE of 18.2%, and CIR of 52.4%, compared to Tanzania’s ROA of 2.3%, ROE of 14.4%, and CIR of 60.7%.

Despite strong profitability, Tanzania’s banking sector remains small relative to GDP. In developed markets, banking assets contribute significantly to economic output. For instance, European Union banks held assets totaling EUR 27.9 trillion in 2024, forming more than 200% of the regional GDP. Similarly, the U.S. banking sector’s total assets equated to about 90% of GDP, while China’s banking industry was even larger, reaching approximately 214% of GDP in 2021.

However, Kenya leads in profitability, with higher ROA (3.5%) and ROE (18.2%) compared to Tanzania’s 2.3% and 14.4%, respectively.

Key Factors Driving Performance

The success of Tanzania’s banking sector in 2024 was driven by strong leadership, sound management practices, and strategic economic policies.

Financial stability was supported by robust economic growth of 5.4%, stable inflation, and prudent monetary policies, with the Bank of Tanzania (BOT) maintaining a Central Bank Policy Rate (CBR) of 6% throughout the year.

Additionally, improved asset quality, reflected in a significant decline in non-performing loans to 5.0%, along with high capital adequacy ratios, ensured continued financial stability.

Challenges persist in credit risk management and operational efficiency, particularly for smaller banks. High CIR levels indicate that banks need to optimize their operational frameworks, adopt cost-cutting measures, and enhance digital transformation initiatives.

Outlook and Opportunities

While Tanzanian banks outperform their regional counterparts in profitability metrics such as ROA and ROE, the sector remains relatively small.

Improving the cost-to-income ratio is critical for enhancing efficiency. Comparatively, China’s banking sector, despite lower profitability ratios, has a massive asset base, reflecting the scale of its financial system.

To strengthen its banking sector, Tanzania should focus on:

-Enhancing operational efficiency through digital transformation, automation, and regulatory reforms.

-Expanding mobile banking and financial inclusion initiatives to increase banking penetration.

-Encouraging foreign investments to boost sectoral growth and competition.

-Implementing policies to improve credit risk management and reduce non-performing loans.

“There are big chances that banks will continue to make more profits and grow in both short and long terms.”

Reginal Massawe, MD, AML Finance

By optimizing key performance indicators such as ROE, ROA, and CIR, Tanzania’s banking industry is well-positioned for transformative growth.

With strategic reforms, the sector can significantly enhance its contribution to national economic development and compete more effectively with regional and global counterparts.

Reginald Massawe, Managing Director of AML Finance, concludes, “Given the fact that the size of banks’ assets against the GDP in Tanzania is still small, there are big chances that banks will continue to make more profits and grow in both short and long terms.”