Mining

Mining in Tanzania

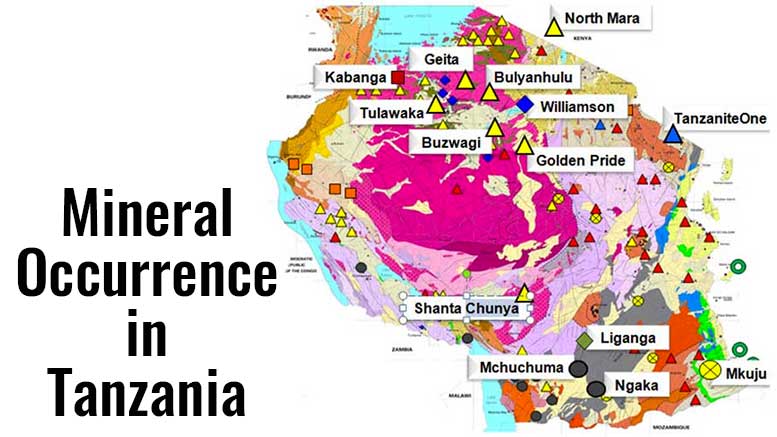

Mining in Tanzania includes metals (gold, iron ore, nickel, copper, cobalt, silver), industrial minerals (diamonds, tanzanite, ruby, garnet, limestone, soda ash, gypsum, salt, phosphate, gravel, sand, dimension stones and lately graphite), and fuel minerals (coal, uranium).

Mining and quarrying activities in Tanzania contributed 5.1% to its GDP with USD 2.96 billion in 2018, compared to USD 1.9 billion (3.8% of GDP) in 2014, representing an increase of 56%.

Based on Tanzania’s Development Vision 2025 plan, the mining sector is expected to account for 10% of the GDP by that year.

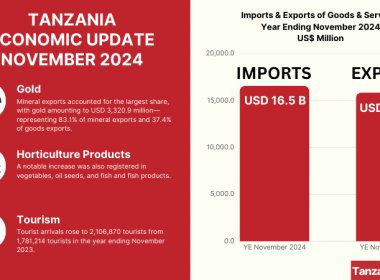

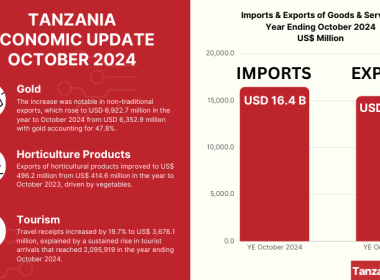

Tanzania Minerals Export

Minerals export accounted for USD 2.3 billion of the total value of Tanzania’s export in 2019 (i.e. 45%) with gold representing more than 90% of the country’s minerals export.

Tanzania exports gold mainly to South Africa, India, Switzerland and Australia.

Metals in Tanzania

Tanzania Gold

Gold reserves in Tanzania are estimated at about 45 million ounces.

Gold exploration has been centered mostly on the greenstone belts around Lake Victoria, where several large deposits have already been discovered and are being developed.

Gold production in Tanzania stood at 39 tonnes in 2018, compared to 43 tonnes in 2017 (-10%) and 40 tonnes in 2014 (-3%).

Tanzania’s gold production increased by more than 700% over the past 25 years, from 5 to 40-50 tonnes per year, while South Africa’s production of gold decreased from over 500 tonnes in 1990 to 117 tonnes in 2018.

Tanzania Iron Ore

Iron reserves in Tanzania are located mainly in Liganga, Uluguru Mountains, Mbabala near Lake Tanganyika, Karema, Manyoro Gondite and Itewe.

The Liganga iron ore mine holds the biggest iron resources in Tanzania with proven reserves of 126 million tonnes.

Tanzania China International Mineral Resources Ltd (TCIMRL) has invested USD 1.8 billion at Liganga for establishment of iron ore mine and iron and steel complex to produce 1.0 million tonnes per year of iron and steel products, vanadium pentoxide and titanium dioxide. The project is expected to be completed by the end of 2020.

Tanzania Nickel

Mineral exploration of nickel in Tanzania takes place at the Kabanga Nickel Sulfide Deposit and the Kapalagulu intrusion.

Kabanga deposit is acknowledged to be one of the largest and richest undeveloped nickel sulfide deposits known at present, of unmatched scale and grade.

The Kapalagulu intrusion present nickel mineralization of both laterite (nickel associated with cobalt) and sulfide (nickel associated with copper and platinum-group elements)-the two main types of nickel deposit currently exploited at a global scale.

Industrial Minerals in Tanzania

Tanzania Gemstones

Tanzania produces a variety of gemstones, including diamonds, tanzanite, amethyst, aquamarine, garnet, ruby, sapphire, and tourmaline.

Tanzania Diamonds

Diamonds in Tanzania are found mainly in the Williamson diamond mine, which is located south of the town Mwanza.

Petra Diamonds, through its subsidiary Williamson Diamonds Limited, holds 75% of the ownership rights over the mine, while the remaining 25% are owned by the Government of Tanzania.

According to Petra Diamonds, the Williamson mine contains large diamond resources of approximately 38.1 million carats.

In 2019, the company achieved the highest level of production at the mine in over 40 years, with 399,615 carats produced (2020: 298,130 carats).

Tanzanite

Tanzanite is found at only one location in the world, the Mererani Hills of Manyara Region in Northern Tanzania.

The production of tanzanite is volatile standing at 21.5 tonnes in 2017, compared to 30.9 tonnes in 2016 and 6.4 tonnes in 2015.

Fuel Minerals in Tanzania

Tanzania Coal

Coal reserves in Tanzania are estimated at 1.9 billion tonnes, 25% of which are proven.

Coalfields with the highest potential are Ketawaka-Mchuchuma in the Ruhuhu Basin, Ngaka fields in the South-West of Tanzania and Songwe Kiwira fields.

Coal is currently exploited in small scale at Kiwira Coal Mine in Mbeya Region and Tancoal Energy Limited Mine at Ngaka in Ruvuma Region.

Coal production in Tanzania increased by 155% over the past five years, from 246 tonnes in 2014 to 628 tonnes in 2018.

Tanzania Uranium

Tanzania has found huge deposits of uranium mainly in Namtumbo (Mkuju), Bahi, Galapo, Minjingu, Mbulu, Simanjiro, Lake Natron, Manyoni, Songea, Tunduru, Madaba and Nachingwea.

One of the major uranium development projects is the Mkuju River Project with estimated reserves of 182.1 million tonnes.

The project’s operator is Mantra Tanzania, a subsidiary of Russia’s Uranium One Group. In 2017 Mantra suspended further development of the project due to low uranium prices.

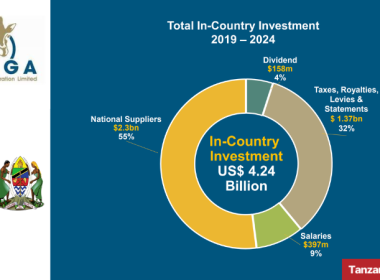

Local Content in Tanzania’s Mining Sector

For a long time, there has been a concern about the limited participation of, and hence, limited benefits to, local communities and businesses in the sector’s value chain.

In response to these concerns, Tanzania introduced the Mining (Local Content) Regulation of 2018, and the consequent Amendments of 2019, to ensure that mining activities’ benefits are shared more equally among its citizens.

This regulation requires, among other things, that mining stakeholders maintain a minimum level of Tanzanian employees, use Tanzanian-licensed service providers, and give preference to Tanzanian-incorporated suppliers who meet certain criteria.

Key Components of Local Content Regulations

1. Local Employment: Mining companies must prioritize Tanzanian workers, ensuring that citizens are employed at all levels, with a focus on training and developing local skills.

2. Local Procurement: A significant portion of goods and services for mining operations must be sourced from Tanzanian suppliers, fostering the growth of local businesses.

3. Skills Development: Mining companies are required to invest in training programs to build the technical and managerial capacities of Tanzanian workers.

4. Corporate Social Responsibility (CSR): Firms are also obligated to contribute to community development by investing in local infrastructure, education, and healthcare.

Impact of Local Content

Although these regulations are meant to increase employment for Tanzanians, greater business opportunities for local suppliers, and improvements in the socio-economic conditions of communities near mining operations, The Tanzania Mining Policy on Local Content Report indicates that there is little evidence that local content policies have so far effectively provided much competitive advantage to locals nor that they have increased mining-based benefits, particularly at the community level.

The implementation of local content policies in Tanzania’s mining sector encounters a range of challenges. A notable challenge lies in the disparity

between required skills and available workforce.

The policy’s goal of boosting local employment is impeded by a shortage of suitably skilled individuals for specialized roles within the mining industry. Bridging this skills gap necessitates the implementation of continuous training and educational initiatives.

Last Updated: 19th September 2024