The Bank of Tanzania (BOT) released its Monthly Economic Review-September 2024 which covers key macroeconomic indicators for the year ending August 2024.

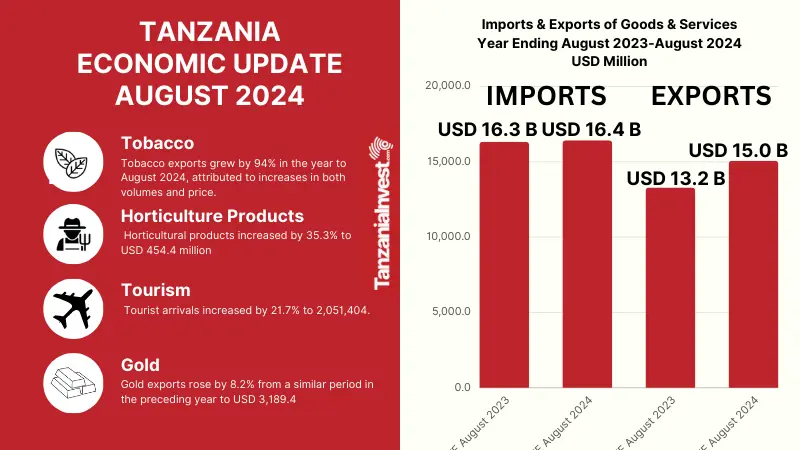

External Sector Performances

The Bank explains that the performance of the external sector has significantly improved, amid global economic recovery.

Strong export growth and a moderate rise in import bills, supported by favorable global commodity prices, bolstered the recovery.

Thus, the current account deficit narrowed to USD 2,567.2 million in the year ending August 2024, from USD 3,846.5 million in the corresponding period in 2023.

Foreign Exchange Reserves

By the end of August 2024, foreign exchange reserves increased to USD 5,379.7 million, sufficient to cover 4.4 months of projected imports of goods and services.

This reserve level is in line with the country’s benchmark.

Exports

Exports of goods and services surged to USD 15,064.6 million in the year ending August 2024, up from USD 13,290.1 million in the same period in 2023.

The growth was largely driven by higher service receipts, particularly from tourism, increased exports of gold, and traditional goods including tobacco, cashew nuts, and horticultural products.

Traditional exports amounted to USD 1,099.9 million during the year ending August 2024, higher than USD 807.9 million in the previous year.

Much of the increase was recorded in the exports of tobacco and cashew nuts, on account of both volume and price effects.

Non-traditional exports were USD 6,568.3 million, compared with USD 6,349.8 million.

The increase was largely driven by gold exports, which rose by 8.2% from a similar period in the preceding year to USD 3,189.4, largely explained by volume and price effects, and horticultural products, which increased by 35.3% to USD 454.4 million, backed by higher shipments of edible vegetables.

On a monthly basis, exports of goods amounted to USD 934.3 million in August 2024, compared to USD 785.3 million in August 2023.

Service and Tourism Receipts

Service receipts surged to USD 6,948.5 million in the year ending August 2024, from USD 5,711.3 million in the previous year, largely driven by travel (tourism) and transport services.

The increase in travel receipts reflects the sustained good performance of the tourism sector, with tourist arrivals increasing by 21.7% to 2,051,404.

Transport earnings, primarily freight charges, amounted to USD 2,597.6 million, up from USD 2,184.7 million.

Imports

Imports of goods and services saw a slight increase to USD 16,427.5 million for the year ending August 2024, up from USD 16,327.7 million in the previous year.

Notable increases were recorded in refined white petroleum products, iron and steel, and electrical machinery and equipment.

Services payments amounted to USD 2,273.3 million for the year ending August 2024, down from USD 2,458.7 million in the year to August 2023.

This decline was driven by a decrease in other services, as freight charges increased consistent with the import bill.

For the year ending August 2024, the primary income account recorded a deficit of USD 1,760.8 million, higher than USD 1,446.4 million recorded in the previous year.

The increase is attributed to a rise in interest payments.

The secondary income account recorded a surplus of USD 556.5 million for the year ending August 2024, compared with USD 637.6 million in the corresponding period in 2023.

The surplus is supported by an increase in personal transfers.