A recent report by Manufacturing Africa titled “From Minerals to Manufacturing: Africa’s Competitiveness in Global Battery Supply Chains”, highlights Tanzania’s potential to become a key supplier of low-cost lithium iron phosphate (LFP) batteries by 2030.

The report emphasizes the role of resource-rich countries like Tanzania in meeting the surging global demand for batteries, projected to reach 7.8 terawatt-hours (TWh) by 2035.

This demand is driven by the growth in electric two- and three-wheelers and battery energy storage systems (BESS), expected to require an additional 3 to 4 gigawatt-hours (GWh) annually by 2030.

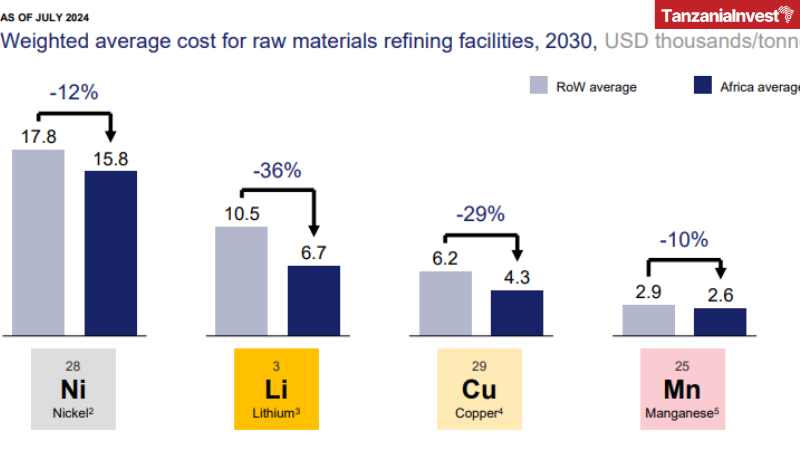

Tanzania is uniquely positioned due to its abundant deposits of cobalt, nickel, copper, and manganese—key components for lithium-ion batteries, which account for 80% of global battery demand.

Therefore, Tanzania could supply LFP batteries at costs of US$ 68 per kilowatt-hour (kWh), competitive for European markets.

If realized, this opportunity could generate annual revenues of US$ 10–15 billion and create approximately 22,000–25,000 jobs by 2030, rivaling global manufacturers like China, Indonesia, Europe, and the US.

Despite its advantages, Tanzania faces hurdles in realizing its battery market ambitions.

However, the report underscores the need for significant investment in mining and refining capabilities whereby competitive refining plants require an annual capacity of 10,000–15,000 tonnes, with capital expenditures estimated between US$ 0.5 billion and US$ 1.5 billion.

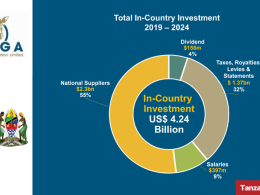

Addressing these issues through robust government policies and attracting foreign direct investment (FDI) will be pivotal in developing the necessary manufacturing base to capitalize on the global shift towards sustainable energy solutions.

In this regard, Tanzania has already established policies that directly impact the battery manufacturing value chain, with a ban introduced in 2024 on exports of raw lithium, requiring concentrates to be refined into ores before being exported to encourage local refining and encourage investments in the local value chain.

Tanzania’s Growing Mining Potential

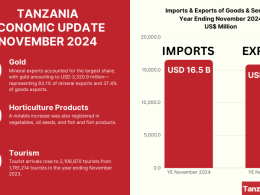

Tanzania is emerging as a significant player in the global mining sector, particularly for critical minerals such as cobalt, nickel, copper, and manganese.

The country is focusing on developing its mineral resources to support the growing demand for these metals, especially in the context of electric vehicle (EV) batteries and renewable energy technologies.

One of the key projects in Tanzania is the Kabanga Nickel Project, located in the north-western part of the country.

The project boasts an estimated reserve of approximately 44 million tons, with an average nickel grade of 2.61%, copper at 0.35%, and cobalt at 0.19%.