The Parliament of Tanzania has published on 29th June 2017 the proposed draft legislation to change the legal framework governing the natural resources sector in Tanzania.

The draft bill is to be debated by the Parliament in an extended Parliamentary session.

OreCorp (ASX: ORR), a Western Australian based mineral company with gold and base metal projects in Tanzania commented on the draft legislation with concerns: “Based on the Company’s preliminary review of the draft legislation, the Company believes that, if passed by the Tanzanian Parliament without any substantial amendments, the proposed changes may potentially have an adverse effect on the Nyanzaga Project.”

The Nyanzaga Gold Project is a joint venture with Acacia Mining (LSE: ACA), Tanzania’s largest gold miner.

“Acacia will review the proposed changes in the context of our existing agreements and will provide further updates as appropriate,” the company commented on its website.

Shanta Gold (AIM: SHG), another gold mining company with interests in Tanzania with its flagship New Luika Gold Mine commented: “Shanta will seek advice on the proposed changes and will provide further updates as appropriate.”

Meanwhile, both Cradle Resources (ASX: CXX) that owns 50% of the niobium Panda Hill deposit in Tanzania and Graphex Mining (ASX: GPX) that coarse flake Chilalo Graphite Project in south-east Tanzania have been granted a trading halt by the Australian Securities Exchange, pending details of draft changes to mining legislation proposed by the Tanzanian government.

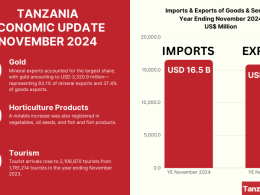

In addition to the new draft mining legislation, the Parliament of Tanzania has also approved the new Finance Act, which will impose a 1% clearing fee on the value of all minerals exported from the country from 1 July 2017.

Mining has placed Tanzania in the higher ranks of African economies in terms of attracting FDIs.

The mining sector share of the country’s GDP at current prices was 3.4% in the financial year 2014/15.

However, Tanzania’s National Five Year Development Plan 2016/17 – 2020/21, stresses that most of the mineral resources are being exported in their raw form without being processed, denying the country jobs and value addition activities.