A consortium of lenders has signed a non-binding indicative Term Sheet to provide US$176.6 million in debt funding for the Ngualla Rare Earth Project in Tanzania’s Songwe Region.

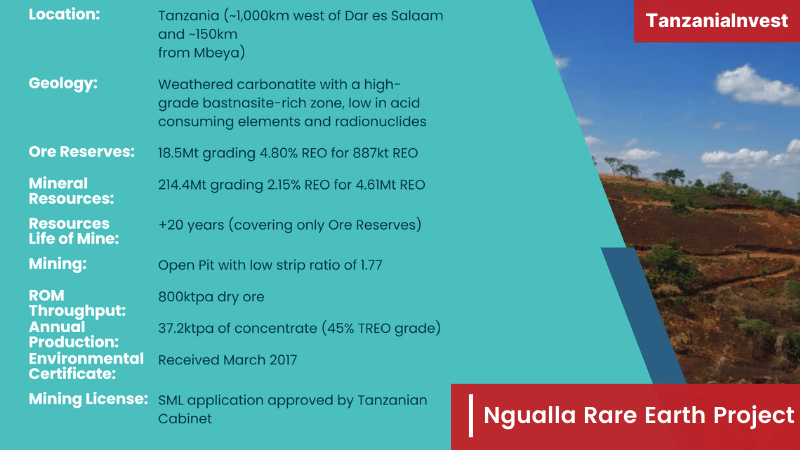

The Ngualla Project, led by Peak Rare Earths Limited (ASX: PEK), aims to develop a major source of rare earth minerals, which are crucial for various high-tech industries, including renewable energy, electronics, and automotive sectors. This financial commitment underscores the project’s potential to become a key player in the global rare earth supply chain.

The Lenders Consortium comprises prominent financial institutions such as the Industrial Development Corporation of South Africa Limited, Development Bank of Southern Africa Limited, CRDB Bank PLC (Tanzania), NMB Bank PLC (Tanzania), and an East African commercial bank. Additionally, the Export Credit Insurance Corporation of South Africa has expressed interest in providing political and commercial risk insurance for the project.

The debt facility’s key features include a total debt of US$176.6 million, a repayment period of up to nine years, and provisions for a grace period during construction and ramp-up phases. The facility also includes a cost overrun provision and market-standard debt covenants, ensuring robust financial management.

The funding structure includes a two-tranche, senior secured project finance facility, with one tranche covered by risk insurance and the other consisting of both USD and Tanzanian Shillings.

With the Term Sheet signed, the consortium will initiate comprehensive due diligence and formal credit approval processes, aiming for a Financial Investment Decision by December 2024.

To further strengthen the project’s financial base, Peak is pursuing a strategic partnership to attract a project-level investor, minimizing the need for equity funding. Concurrently, a Cost and Optimization Study is underway to enhance production efficiency and reduce costs, with revised estimates expected before the December 2024 investment decision.

Peak Rare Earths CEO Bardin Davis highlighted the significance of this development, stating, “We are delighted by the strong support from some of Africa’s leading development finance institutions and export credit agencies. It is particularly pleasing to have strong participation from major Tanzanian and East African banks. This marks an important validation of the Ngualla Project and another major milestone as we progress towards a Final Investment Decision.”