Tanzania’s banking sector has demonstrated strong performance in the third quarter of 2024, according to the latest financial analysis report by AML Finance Limited.

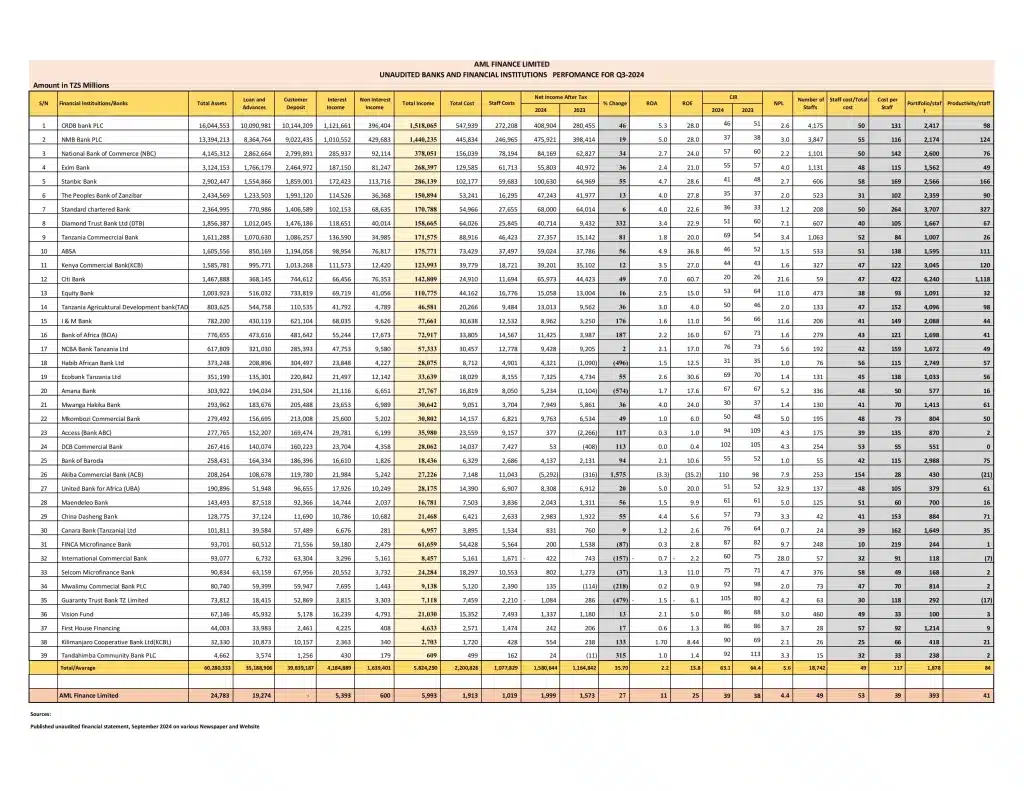

The sector’s total assets reached TZS 60.28 trillion, with loans and advances amounting to TZS 35.19 trillion and customer deposits totaling TZS 39.83 trillion.

Key Highlights

Profitability: The sector’s net income after tax increased by 35.70% compared to the same period in 2023, reaching TZS 1.58 trillion. This significant growth indicates improved operational efficiency and a favorable business environment.

Asset Quality: The average Non-Performing Loan (NPL) ratio stood at 5.6%, suggesting relatively good asset quality across the sector. However, this figure varies considerably among individual banks[1].

Efficiency: The sector’s average Cost-to-Income Ratio (CIR) improved slightly from 64.4% in 2023 to 63.1% in 2024, showing a marginal increase in operational efficiency.

Top Performers

- CRDB Bank PLC maintained its position as the largest bank by total assets (TZS 16.04 trillion), followed by NMB Bank PLC (TZS 13.39 trillion). CRDBsaw a 46% increase in net income after tax, from TZS 280,455 million in 2023 to TZS 408,904 million in 2024.

- NMB Bank PLC led in net income after tax with TZS 475.92 billion, followed closely by CRDB Bank PLC at TZS 408.90 billion. NMB experienced a 19% growth, with net income after tax rising from TZS 398,414 million to TZS 475,921 million.

- Stanbic Bank showed significant improvement, with a 55% increase in net income after tax and a reduction in CIR from 48% to 41%.

- The top five banks by total assets are CRDB Bank PLC, NMB Bank PLC, National Bank of Commerce (NBC), Exim Bank, and Stanbic Bank.

- Smaller banks like Diamond Trust Bank and Tanzania Commercial Bank (TCB) showed substantial growth in net income after tax, with increases of 332% and 81% respectively.

Challenges

- Some banks, such as Akiba Commercial Bank (ACB) and DCB Commercial Bank, reported losses or minimal profits, indicating ongoing challenges for certain institutions.

- The sector’s average cost-income ratio (CIR) of 63.1% suggests there’s still room for improvement in operational efficiency across many banks.

Commenting on the results, AML Finance Founder and Managing Director Reginald Massawe said, “Banks, especially the large ones, are doing exceptionally well. The smaller banks are not, and there is a need to investigate why, as one would expect the smaller banks to have a higher growth rate than the larger banks. Additionally, there is a weak relationship between financial sector growth and economic growth, suggesting that there is still room for the financial sector to contribute more to mainstream economic growth.”

Tanzania Banking Sector Latest Trends

The Tanzanian banking sector has been experiencing a significant trend towards consolidation in recent years, which has continued into 2024.

With ongoing mergers and acquisitions, the number of licensed banking institutions in Tanzania has been steadily decreasing, from a peak of 59 in 2017 to 46 in late 2024.

Notable consolidation activities in 2024 include Selcom Tanzania, a Pan African fintech specializing in digital payments, acquiring Access Microfinance in June and becoming Selcom Microfinance Bank Tanzania, and Access Bank Plc which successfully completed its acquisition of African Banking Corporation Tanzania Limited (BancABC Tanzania) and the consumer, private, and business banking operations of Standard Chartered Bank Tanzania to form a new entity known as Access Bank Tanzania.

The consolidation trend is driven by several factors, including capital adequacy requirements, regulatory encouragement, and intense market competition, with many banks pursuing similar strategies.

Smaller banks are facing challenges in meeting capital requirements, leading to mergers or acquisitions by larger institutions.

Banking leaders in Tanzania generally view consolidation as an ongoing trend. Odunayo Akinyede, Managing Director of GTBank Tanzania, firmly believes that the consolidation trend will persist, with more banks opting for consolidation.

Other banking leaders see a future where banks and fintechs will work together, potentially leading to new forms of consolidation or partnerships.

The Bank of Tanzania (BOT) is encouraging financial institutions to merge to enhance their financial strength and benefit from synergies.