The Bank of Tanzania (BOT) released its Monthly Economic Review-November 2024 which covers key macroeconomic indicators for the year ending October 2024.

External Sector Performances

The Bank explains that the external sector continued to strengthen, reflecting the recovery of global economic conditions.

The current account deficit narrowed to US$ 2,212.3 million in the year ending October 2024, compared with US$ 3,281.9 million in the corresponding period in 2023.

The improvement was driven by sustained growth in exports, alongside favourable global commodity prices.

Foreign Exchange Reserves

Foreign exchange reserves amounted to US$ 5,417.74 million at the end of October 2024, sufficient to cover 4.4 months of projected imports of goods and services, surpassing the national benchmarks of 4 months.

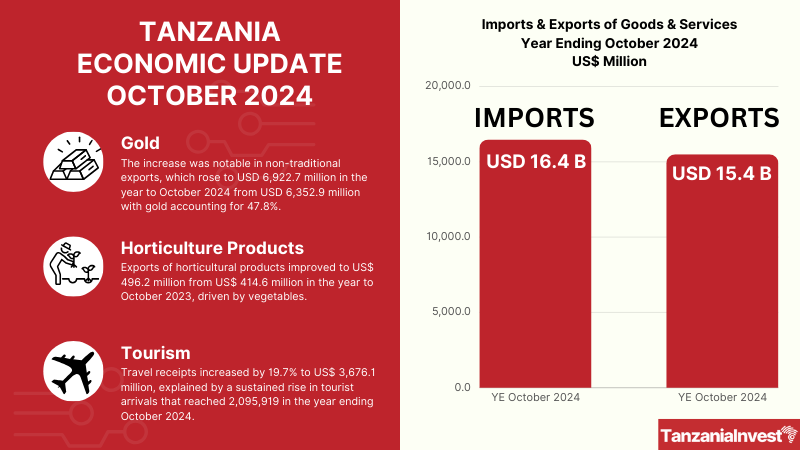

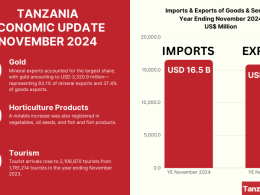

Exports

Exports of goods and services amounted to US$ 15,497.8 million in the year ending October 2024, an increase of 12.9% from the preceding year.

This growth resulted from a strong rebound in tourism and an increase in key export commodities, in particular gold, tobacco, cashew nuts, and horticultural products.

The export of traditional goods increased to US$ 1,148.3 million from US$ 910.2 million in the year ending October 2023, driven by tobacco, coffee, and cashew nuts.

The increase was also notable in non-traditional exports, which rose to US$ 6,922.7 million, from US$ 6,352.9 million, with gold accounting for 47.8%.

Exports of horticultural products improved to US$ 496.2 million from US$ 414.6 million in the year to October 2023, driven by vegetables.

On a month-to-month basis, exports of goods amounted to US$ 940.4 million in October 2024, compared with US$ 693.2 million in a similar period in 2023.

Service and Tourism Receipts

Service receipts increased to US$ 6,950.6 million from US$ 6,041.5 million in the year ending October 2023, with earnings from travel (tourism) and transport services backing the performance.

Travel receipts increased by 19.7% to US$ 3,676.1 million, explained by a sustained rise in tourist arrivals that reached 2,095,919 in the year ending October 2024 following sustained Government and private sector promotion efforts.

Meanwhile, transport earnings, mainly from freight charges, increased to US$ 2,693.6 million from US$ 2,340.8 million in the year to October 2023, mainly due to improvements in port efficiency and transport infrastructure.

A month-on-month analysis also indicates a notable improvement in service receipts, rising to US$ 616 million from US$ 607.7 million in October 2023.

Imports

Imports of goods and services increased by 2.3% to US$ 16,485.8 million from the level recorded in October 2023, driven by iron and steel.

Other imports with notable increases were sugar for industrial use, plastic items, and footwear.

On a monthly basis, goods imports amounted to US$ 1,257.6 million, compared with US$ 1,298.6 million in October 2023.

Services payments decreased to US$ 2,371.7 million in the year ending October 2024, from US$ 2,410.9 million in 2023.

Monthly, service payments amounted to US$ 236.9 million compared with US$ 214.6 million in October 2023.

The primary income account balance deteriorated, recording a deficit of US$ 1,777.8 million in the year ending October 2024, relative to a deficit of US$ 1,542.4 million in the corresponding period in 2023.

The increase was associated with interest payments abroad.

On a month-to-month basis, the deficit narrowed to US$ 166.7 million from US$ 194.2 million in October 2023.

As for the secondary income account, the surplus decreased to US$ 553.4 million from US$ 641.5 million in the year to October 2023.

The account registered a surplus of US$ 44.8 million in October compared with US$ 45.2 million in October 2023.