On 31st October 2024, the French-Tanzanian Chamber of Commerce (FTCC) hosted a workshop focused on navigating Tanzania’s complex tax environment, particularly for non-resident companies.

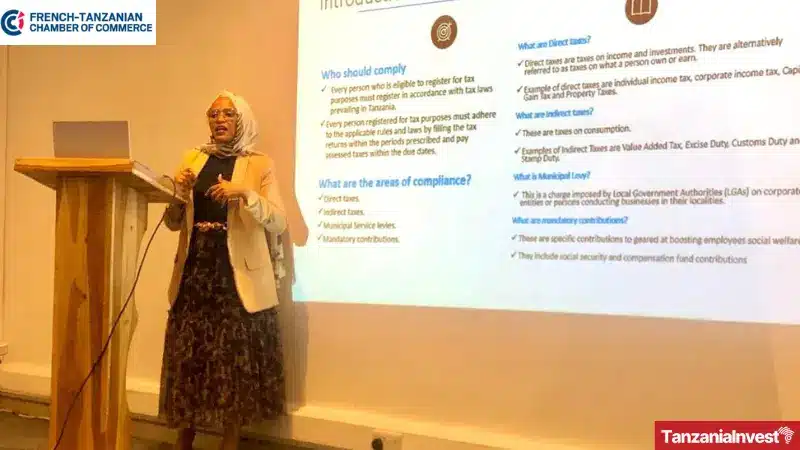

The workshop, led by Maryam Omary, Compliance and Regulatory Advisor at Maurel & Prom Tanzania, focused on key taxation issues, including withholding tax, double tax agreements, the implications of permanent establishment rules, and the importance of maintaining audited financial statements for compliance.

Participants also received guidance on navigating registration requirements with Tanzanian authorities such as the Business Registrations and Licensing Agency (BRELA), the Tanzania Revenue Authority (TRA), and the National Social Security Fund (NSSF) including the steps to obtain necessary business licenses.

Additionally, the workshop covered tax compliance obligations for resident companies, including corporate income tax, VAT, and other regulatory requirements.

During the workshop, participants raised several interconnected questions and concerns related to tax compliance.

Key issues included the relationship between business licenses and city development levies, the appropriate payment locations for businesses operating in multiple areas, and the renewal process for business licenses.

Additional concerns centered around the necessity of filing returns for registered but non-operational companies, compliance penalties that could exceed tax liabilities, and the handling of transactions between related parties. Participants sought clarification on the preparation of financial statements when companies are not generating income, highlighting the complexities faced by businesses in maintaining compliance.

In response to these issues, Omary emphasized the importance of proactive compliance and clear communication with local authorities, filing returns on time, even if they indicate zero income to avoid deregistration, adhering to the arm’s length principle for related party transactions, and stressed the importance of accurate financial statement preparation.

Overall, the workshop underscored the critical need for businesses to stay informed about compliance and regulatory requirements in Tanzania, reinforcing that diligence in these areas is crucial for successful operations in the market.

About FTCC

Founded in 2019, the French-Tanzanian Chamber of Commerce (FTCC) is a non-profit organization affiliated with CCI France International, a network of 118 French bilateral Chambers in 93 Countries.

The FTCC assists French companies and entrepreneurs in setting up in Tanzania, supporting their development projects, and promoting exchanges related to business opportunities between France and Tanzania.

Additionally, it supports business growth in both countries by assisting with trade, investment, finance, and industry activities, and encourages small and medium enterprises to explore and establish operations in Tanzania and France.