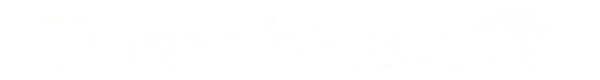

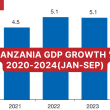

On 24th April 2023, the International Monetary Fund (IMF) Executive Board completed the first review of the Extended Credit Facility (ECF) Arrangement and the 2023 Article IV Consultation with Tanzania.

Approval of the first review enables the immediate disbursement of SDR 113.37 million (about USD 153 million) for budget support, bringing Tanzania’s total access under the arrangement to about USD 304.7 million.

Tanzania’s three-year ECF Arrangement for total access of SDR 795.58 million (200% of quota- about USD 1,046.4 million at the time of program approval) was approved on July 18, 2022.

The arrangement aims to support economic recovery, preserve macro-financial stability, and promote sustainable and inclusive growth.

Reforms focus on strengthening economic recovery, preserving macroeconomic stability, and supporting structural reforms towards sustainable and inclusive growth

They also centre on strengthening fiscal space to allow for much-needed social spending and high-yield public investment, enhancing the monetary policy framework and improving financial sector supervision, and advancing structural reforms.

In its first review, the IMF notes that Tanzania’s economic reform program is progressing well in a challenging global economic environment and the authorities remain committed to the Extended Credit Facility Arrangement.

All quantitative performance criteria and indicative targets for December 2022 were met.

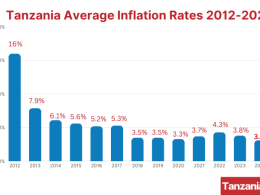

Following the Executive Board’s discussion, Antoinette Sayeh, Deputy Managing Director and Acting Chair, issued the following statement: “The Tanzanian authorities remain committed to their economic reform program despite a challenging global economic environment. Efforts to enhance domestic revenue mobilization and improve the efficiency of expenditures will help create the fiscal space needed to finance priority investment and social spending while safeguarding debt sustainability. Strengthening public finance management and oversight of state-owned enterprises is critical to contain fiscal risks. While Tanzania’s risk of debt distress remains moderate, it is important to continue prioritizing concessional financing and ensure that fiscal risks from contingent liabilities are well-contained. While inflation remains below target, the Bank of Tanzania should stand ready to tighten monetary policy as needed while allowing more exchange rate flexibility against external shocks.”

She also added that “Structural reforms are essential to promote inclusive, resilient, and sustainable growth. Business reforms should focus on streamlining bureaucratic procedures, simplifying the business regulatory regime, and enhancing regulatory transparency. Implementation and enforcement of the authorities’ anti-corruption strategy and establishing a risk-based AML/CFT supervisory approach would help improve governance and address deficiencies in Tanzania’s AML/CFT framework. Tanzania’s high vulnerability to climate change calls for increasing resilience through mitigation and adaptation policies.”