The Government of Tanzania, in collaboration with CRDB Bank, has launched the Samia Infrastructure Bond, an initiative to address financing challenges in road infrastructure projects and empower local contractors.

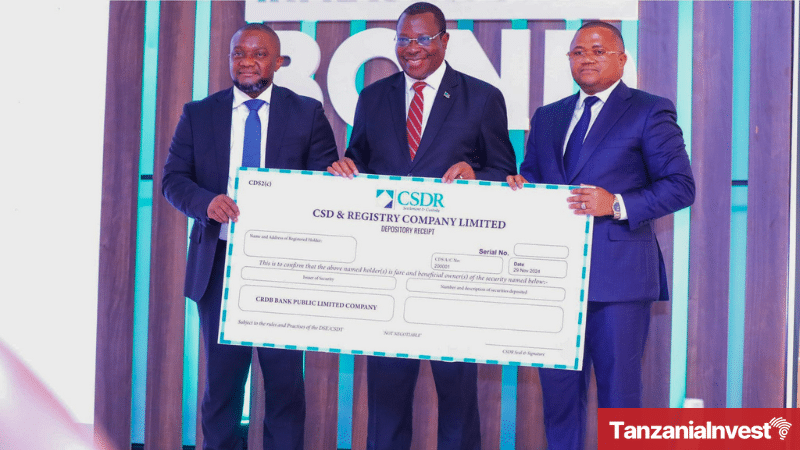

Officially unveiled on November 29, 2024, by Vice President Dr. Philip Mpango in Dar es Salaam, the bond aims to support projects under the Tanzania Rural and Urban Roads Agency (TARURA) by providing sustainable funding for construction and rehabilitation efforts across the country.

It also aims to reduce delays caused by budgetary cycles, ensuring that TARURA’s projects are executed efficiently and on time.

The proceeds from the bond will address liquidity challenges faced by local contractors involved in TARURA projects, facilitating smoother project implementation and strengthening the capacity of local businesses to participate in national development initiatives.

The Samia Infrastructure Bond is spearheaded by the President’s Office – Regional Administration and Local Government (TAMISEMI), which oversees TARURA.

The bond, with a principal value of TZS 150 billion, offers an annual fixed interest rate of 12%, with tax-exempt quarterly coupon payments scheduled for February, May, August, and November.

It is set to mature in February 2030 and will be listed on February 10, 2025. With a minimum investment requirement of TZS 500,000, the bond encourages the participation of individuals, cooperatives, pension funds, and institutional investors.

Speaking during the launch, Vice President Dr. Mpango emphasized the importance of educating the public on the bond and broader investment opportunities, noting that only 18% of Tanzanians currently use their savings for investments, as revealed by FinScope surveys in 2017 and 2023.

He urged CRDB Bank and TAMISEMI to simplify financial literacy efforts to attract more investors and ensure that the bond benefits as many Tanzanians as possible.

The Vice President also called on TARURA to incorporate modern technology in road and bridge construction to enhance quality, reduce costs, and ensure the sustainability of infrastructure.

Hon. Mohamed Mchengerwa, Minister of State at TAMISEMI, highlighted that the bond will enable contractors to overcome financial constraints, complete projects efficiently, and receive timely payments, thereby fostering sustainable economic growth.

CRDB Bank CEO Abdulmajid Nsekela affirmed the bank’s commitment to national development, noting that CRDB has consistently supported strategic initiatives, including infrastructure projects in transport, energy, and sustainability.

He underscored that the Samia Infrastructure Bond aligns with the bank’s focus on inclusive and transformative financing to meet Tanzania’s development objectives.

Tanzania Paved Roads Network Expansion

With the Government’s continued investment in road infrastructure, the national paved road network has grown from 13,235 kilometers in 2020 to 15,366 kilometers in 2024.

TARURA’s budget has more than doubled, from TZS 414.5 billion in 2019/20 to TZS 841.2 billion in 2024/25, showcasing the government’s commitment to expanding and maintaining critical road infrastructure.

The Samia bond aligns with Tanzania’s Vision 2025, which prioritizes enhanced connectivity and economic empowerment in underserved areas. Improved road networks are expected to facilitate trade, reduce transportation costs, and increase access to essential services, fostering inclusive socio-economic growth.