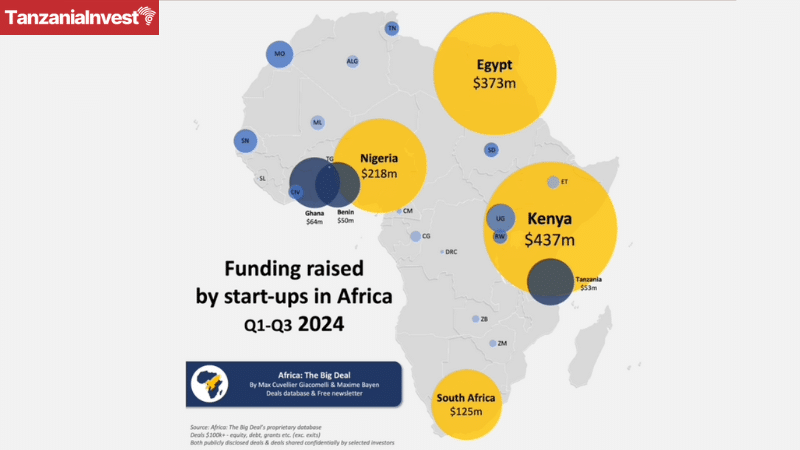

According to Africa: The Big Deal, Tanzania’s start-up ecosystem secured US$ 43 million in Q3 2024, making it one of Africa’s top three destinations for start-up funding, alongside Egypt and Kenya.

The overall funding raised across Africa reached approximately US$ 636 million, reflecting a substantial increase from previous quarters.

This positions Tanzania ahead of several other markets in the region, including South Africa (US$ 40 million), Ghana (US$ 35 million), and Nigeria (US$ 26 million).

However, it still trails behind the dominant players in Africa—Egypt and Kenya—which raised US$ 272 million and US$ 201 million respectively, accounting for over 75% of total funding across the continent.

The majority of Tanzania’s funding success can be attributed to the fintech sector, with the start-up Nala (an international money transfer app) raising US$ 40 million out of a total of US$ 53 million for the year.

This represents a major increase from US$ 25 million raised by Tanzanian startups in 2023.

is attributed to several key factors including supportive government initiatives, such as the Bank of Tanzania’s Instant Payment System (TIPS), that have bolstered confidence among fintech founders and investors.

TIPS connects different payment providers, allowing customers and organizations to send digital payments to each other instantly.

Additionally, regulatory improvements, including those enforced by the Personal Data Protection Commission (PDPC) have enhanced consumer trust in digital platforms.

PDPC is a regulatory authority responsible for overseeing and enforcing data protection laws to safeguard Tanzania individuals’ personal information.

These developments have created an environment conducive to attracting investment and fostering innovation.

Increased mobile penetration and internet accessibility have transformed the landscape, allowing digital financial solutions to reach underbanked communities and aligning with government objectives for a digital economy.

Startups In Tanzania

According to the 2023 Tanzania Startup Ecosystem Report by the Tanzania Startup Association (TSA), the country is home to 842 startups, with Dar es Salaam leading as the primary hub, hosting approximately 66.56% of these ventures.

The top five sectors in which these startups operate are: Software as a Service (SaaS) at 19.92%, AgriTech at 19.17%, E-commerce and Retail Tech at 10.15%, HealthTech at 9.21%, and Fintech at 8.83%.

These startups employed 89,509 people in 2022, from 78,071 in 2021, resulting in an average employment capacity of 133 per startup.

Despite their positive impact on the economy of Tanzania, startups face numerous challenges, such as access to funding, investments, talent, support, and regulatory barriers.

Tanzania’s government has been increasingly recognizing the importance of startups and entrepreneurship for economic growth and job creation in recent years, and in 2023 it announced it will release a comprehensive Startup Policy and Act to address the pressing challenges startups face.