In October 2024, the Presidential Commission on Tax Reforms in Tanzania announced that it is seeking public input to reform the country’s tax system.

The Chair of the Tax Commission, Ambassador Ombeni Sufue has encouraged universities, research institutions, and media outlets to facilitate discussions and raise awareness about the reform process.

He emphasized that the goal is to gather a wide range of perspectives to inform the commission’s recommendations for improving the tax system.

Sufue highlighted “We would like to inform the public that the commission has begun its work and is now ready to engage with all stakeholders, whether individually or through professional associations, business communities, and so forth.”

“The commission will ensure that the final recommendations reflect the experiences and input of everyone contributing to improving the country’s tax,” added SufueThe commission has opened multiple channels for Tanzanians to share their views, including:

Online Surveys: Available at edodoso.gov.go.tz (survey number 544978).

Email Submissions: Dedicated email addresses have been created for feedback: tume@taxreform.go.tz and maboresho.kodi@taxreform.go.tz.

Text Messaging: Citizens can send their opinions via SMS to +255 748 755 677 or +255 738 588 813.

Tanzania’s Tax Commission

The Tax Commission was launched in October 2024, following a period of growing dissatisfaction among businesses and investors regarding the existing tax administration practices.

The commission’s objectives include addressing complaints about weaknesses in tax administration and ensuring transparency in the Tanzania Revenue Authority’s (TRA) collection methods.

It also aims to include more taxpayers, especially from the informal sector, which constitutes a significant part of the economy.

The commission is also responsible for developing strategies that encourage taxpayers to comply willingly with tax obligations.

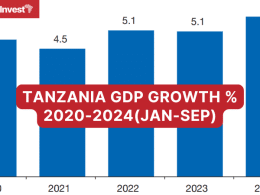

In addition, the commission aims to raise the tax-to-GDP ratio from approximately 12.1% to at least 15% by the fiscal year 2026/27, aligning with regional benchmarks necessary for sustainable development.

The commission is expected to operate for six months, during which it will engage with various stakeholders, hold symposiums, and analyze the current tax system.