From 7th-9th October 2024, the Investing in Africa Conference (AFSIC) 2024 was held at the Park Plaza in Westminster in London and profiled a record high 350 deals valued at over US$ 10 billion.

AFSIC is among the most important annual investment events focused on accelerating Africa’s economic emergence by connecting investment opportunities across the continent.

Its mission is to drive sustainable growth by transforming the business, trade, and investment landscape while boosting incomes across all sectors at a continental scale.

This year’s event attracted over 1,347 attendees, comprising 1,219 in-person delegates, 380+ speakers, 128 digital ticket holders, government officials, trade promotion agencies, and industry leaders from various sectors such as agriculture, fintech, energy, and technology, who engaged in more than 4,300 scheduled meetings.

The event introduced several new networking initiatives designed to enhance collaboration among investors and entrepreneurs.

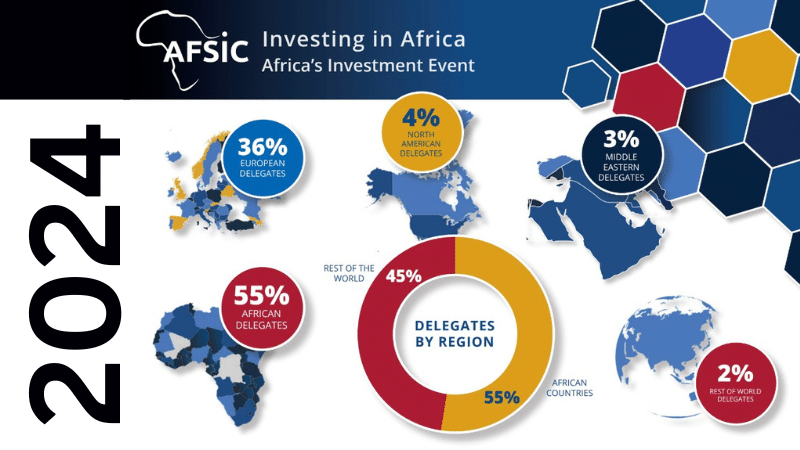

The attendee demographic showcased notable diversity, with 55% of delegates from African countries, 36% from Europe, 4% representing North America, 3% from the Middle East, and the remaining 2% from other regions.

Among the attendees were representatives from 163 government and trade promotion agencies, along with a mix of private sector companies and financial institutions. This diverse representation facilitated rich discussions on investment opportunities and challenges across the continent.

While optimism permeated the AFSIC 2024, discussions highlighted challenges that investors face in Africa and launched a new stream dedicated to AI and technology investments.

One of the conference’s focus was on innovative financing solutions aimed at transforming Africa’s agricultural sector.

A session led by the London Stock Exchange (LSE) focused on exit strategies for investments on the continent. The panel addressed hurdles such as underdeveloped capital markets and political instability that could erode investment value.

A representative from the LSE highlighted that exiting investments in Africa can pose various challenges without careful planning, emphasizing the importance of understanding these dynamics to maximize returns.

Commenting on the event, Jeremy Quainoo from JUMO, a financial technology company that partners with banks, MNOs, and other e-commerce players to deliver financial choices to customers across Africa and Asia highlighted: “Representing Ghana and the fintech industry at AFSIC was an incredible experience. The discussions on sustainable investment opportunities in oil and gas, fintech, textiles and garments, agriculture, and microfinance highlighted the vast potential for growth in these vital sectors.”

On their part, a representative from Heifer International, a global nonprofit organization dedicated to eradicating poverty and hunger through sustainable, community-based development highlighted: “AFSIC 2024 wrapped up on a high note. We were pleased to present Heifer International’s approach to innovative financing in agriculture and how we’re working with governments and other strategic partners to drive real impact for smallholder farmers across Africa. The connections and insights gained will strengthen our mission to empower farmers and promote sustainable food systems on the continent.”

CS Summi Gupta from Unified Vision Capital, a financial services firm in India, offering investment banking, corporate finance, and private equity in various sectors such as infrastructure, IT, and energy emphasized: “The last three days at AFSIC have been both inspiring and productive[…] Our discussions around innovative financing solutions for corporate clients across Africa were met with tremendous enthusiasm. This reaffirms our commitment to accelerating growth and development across the continent”.

Saskia Nysschens from Anza Capital an investment firm addressing the funding gap for early-stage businesses in Africa, with a focus on gender-inclusive tech businesses in Southern Africa remarked: “As a VC fund committed to supporting early-stage companies, it was a privilege to connect with visionary entrepreneurs and investors[…] The energy, passion, and momentum were palpable, revealing untapped opportunities that demand attention”.

With plans already underway for AFSIC 2025 scheduled for 14th-15th October at the same venue in London, organizers aim to further enhance this premier platform for investment in Africa. The growing interest from global investors underscores the continent’s potential as a leading investment destination.

About AFSIC

AFSIC is an annual investment event focused on the continent, taking place outside Africa, and aims to connect African businesses with global investors.

Since its inception in 2013, AFSIC has attracted attention from institutional investors, dealmakers, and corporate finance executives who are eager to explore opportunities in Africa’s diverse economies.

The conference highlights a variety of investment opportunities across different sectors, including fintech, agriculture, infrastructure, and sustainable development.

AFSIC features panels and presentations from industry experts who share insights into emerging trends and successful business models in African markets.