The Tanzania Revenue Authority (TRA) has committed to creating a smooth and predictable tax framework that supports business growth while upholding Tanzania’s national interests.

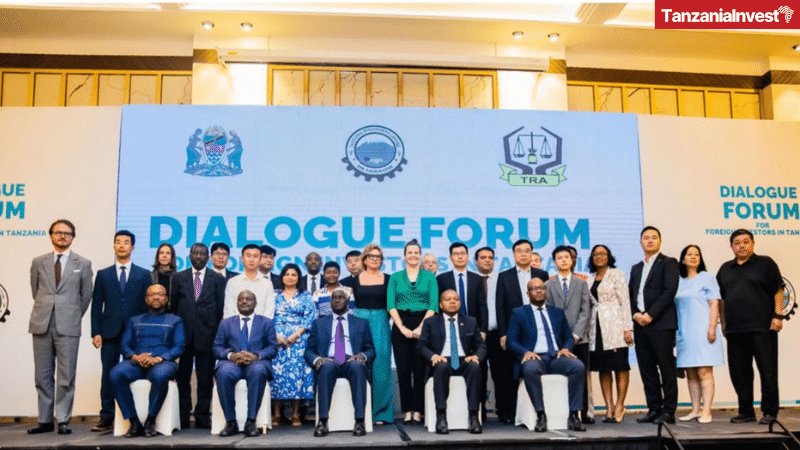

This announcement was made on 31st October 2024 by TRA’s Commissioner General Yusuph Mwenda at the foreign investors’ dialogue forum organized by the Tanzania Investment Centre (TIC) in collaboration with TRA and the Ministry of Foreign Affairs and East African Cooperation in Dar es Salaam.

The event aimed to foster open communication between the Tanzanian government and foreign investors, creating a forum to share experiences, voice challenges, and provide feedback essential for improving Tanzania’s investment climate.

The dialogue centered on several key objectives.

First, attendees were updated on ongoing reforms and developments within the investment landscape, ensuring they remained well-informed about emerging opportunities in the region.

In his video opening remarks, TIC’s Director General Gilead Teri underscored the Tanzanian government’s commitment to improving the business environment under the leadership of President Samia Suluhu Hassan and the new TRA Commissioner General.

He emphasized TIC’s role as a steadfast partner for investors, guiding them throughout their investment journey and incorporating their feedback into ongoing reforms to enhance the investment landscape.

On behalf of Tanzania’s Minister of Planning and Investment, Prof. Kitila Mkumbo, TIC’s Chairman, Bilinith Mahenge, reiterated Tanzania’s commitment to creating an investor-friendly environment through transparent policies, continuous dialogue, and impactful reforms.

He highlighted: “The government recognizes the vital role of the private sector in driving job creation, transforming labor markets, and introducing new technologies. To harness these opportunities, we must ensure that businesses can operate efficiently and transparently.”

“It is crucial that we work together with the relevant to ensure that applications are submitted efficiently and that all necessary certifications are obtained promptly. This includes the certificate of incentives, which is essential for foreign investors to demonstrate eligibility for various benefits,” added Mahenge.

He also encouraged investors to openly share their challenges and assured them of TIC’s open-door policy and commitment to addressing issues collaboratively to support Tanzania’s mutual prosperity with its investment community.

TRA’s Senior Customs Officer, Godfrey Felician, provided an in-depth overview of Tanzania’s tax administration system.

He described the range of taxes applicable to businesses, including income tax, customs tax, VAT, and excise duty, and outlined the tax incentives available to foreign investors.

These incentives include reduced corporate tax rates, tax exemptions for investments within SEZs, and duty exemptions on capital goods, all structured to foster a favorable business environment.

Felician emphasized the Tanzanian government’s commitment to maintaining tax policies that support economic growth, attract foreign investment, and drive overall national development.

Afterward, the meeting allowed investors to share their experiences and provide direct feedback on their projects in Tanzania, helping the government understand both the challenges and successes investors face to better tailor its support.

Discussions also covered urgent issues requiring immediate action from TIC and TRA, as the primary institutions dedicated to supporting investors in Tanzania.

Investors raised specific issues such as delays in land acquisition, parallel taxation by multiple agencies, and challenges in obtaining incentive certificates, which hindered their operational efficiency.

Investors also expressed concerns over import duties and VAT exemptions on essential equipment for healthcare and mining, urging for streamlined processes to facilitate access to these exemptions.

A call was made by the investors for greater transparency and a more structured feedback mechanism, allowing investors to communicate challenges directly to the government and receive timely responses.

Officials from TIC and TRA responded to each concern, explaining current policies and outlining steps aimed at reducing these barriers, ultimately working toward creating a more favorable environment for investment in Tanzania.

Mwenda reaffirmed TRA’s dedication to fostering a business-friendly environment through transparent tax policies that encourage voluntary compliance.

He highlighted: “TRA is committed to creating a smooth and predictable tax framework that supports business growth while upholding our national interests. We recognize the importance of maintaining strong partnerships with stakeholders such as TIC and other esteemed organizations to ensure a productive business relationship.”

Regarding tax liabilities, he said: “We understand that recovering unpaid taxes can be a challenge. We assure you that we will support you in managing tax obligations and will provide tax education to facilitate timely payments. Where unpaid taxes exist, we will follow due procedures for recovery. We emphasize that legal enforcement measures are a last resort. We prefer to resolve issues through dialogue and reminders before taking further action. Our approach is to ensure compliance through proper channels, respecting your rights as taxpayers. We will maintain open communication regarding any assessments or audits, ensuring you receive reasonable time to respond. We are committed to upholding your rights throughout this process.”

On his part, TIC’s Director of Investment Facilitation, Revocatus Rasheli, addressed the importance of tackling pressing issues raised by investors, including tax incentives, administrative challenges, customs clearance procedures, and Special Economic Zones (SEZ) implementation.

Tanzania’s Investment & Tax Framework

Tanzania’s investment framework has undergone significant enhancements in recent years, driven by government reforms aimed at creating a more conducive environment for both domestic and foreign investors.

For instance, the introduction of the new Tanzanian Investment Act of 2022 has been pivotal in attracting investments by offering various incentives, including tax exemptions and reductions for strategic investors.

The minimum investment threshold for domestic investors was lowered to USD 50,000, making it easier for local entrepreneurs to participate in the economy.

TIC also made improvements to the One-Stop Service system, including an online project registration platform that allows investors to register within 1-3 days, have streamlined processes significantly.

As a result, from January to June 2024, TIC registered a total of 409 projects, with a combined capital investment of US$ 3,094.88 million.

However, significant concerns exist regarding tax administration practices affecting foreign investors, with businesses facing bank agency notices that freeze accounts, halt operations, and negatively impact employee salaries and supplier cash flow.

Companies have signed tax concession agreements with the Tanzania Investment Centre and line ministries, only to be advised that the TRA will neither recognize nor honor the agreements because they have not been gazette.

Because of this, in June 2024, prominent ambassadors to Tanzania signed a joint letter bringing to light these issues.

In a prompt response, the Tanzanian Minister of Foreign Affairs and East African Cooperation issued a reply letter acknowledging the concerns and committing to a constructive dialogue.