The Tanzania Investment Centre (TIC) has released data for the first half of 2024, showcasing significant growth in registered investment projects.

H1 2024 Performances

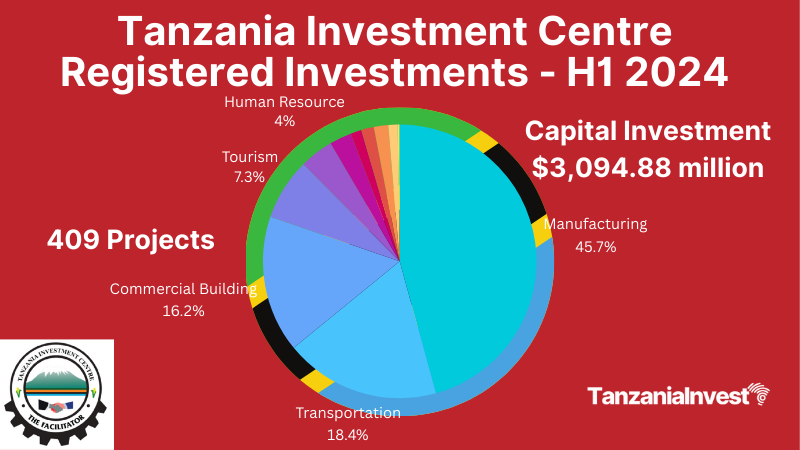

From January to June 2024, TIC registered a total of 409 projects, with a combined capital investment of $3,094.88 million. These projects are expected to create 121,209 jobs.

These projects were distributed across various sectors, with significant contributions from both foreign and local investors, as well as joint ventures (JVs).

The manufacturing sector led with 196 projects, contributing $1,415.73 million in capital and creating 24,628 jobs. The transportation sector followed with 68 projects, generating $570.55 million in capital and providing 7,623 jobs. Agriculture also played a crucial role, with 27 projects and a significant job creation of 78,779 positions, although it contributed a smaller capital amount of $51.57 million.

Sectoral Breakdown and Investment Types

- Manufacturing:

- Projects: 196

- Capital: $1,415.73 million (45.8% of total capital)

- Jobs: 24,628

- Investment Type: Predominantly foreign (116 projects) and JVs (29 projects), with local investments in 51 projects.

2. Transportation:

- Projects: 68

- Capital: $570.55 million (18.4% of total capital)

- Jobs: 7,623

- Investment Type: Mainly local (50 projects), with foreign (11 projects) and JVs (7 projects).

3. Commercial Building:

- Projects: 45

- Capital: $501.90 million (16.2% of total capital)

- Jobs: 3,500

- Investment Type: Primarily foreign (25 projects) with local (17 projects) and JVs (3 projects).

4. Tourism:

- Projects: 40

- Capital: $225.44 million (7.3% of total capital)

- Jobs: 3,268

- Investment Type: Mainly local (24 projects) and foreign (9 projects), with some JVs (7 projects).

5. Human Resource (Health & Education):

- Projects: 5

- Capital: $123.80 million (4.0% of total capital)

- Jobs: 1,032

- Investment Type: Mostly local (3 projects), with foreign (1 project) and JVs (1 project).

6. Energy:

- Projects: 7

- Capital: $80.10 million (2.6% of total capital)

- Jobs: 60

- Investment Type: Predominantly JVs (4 projects) and foreign (2 projects).

7. Services:

- Projects: 10

- Capital: $39.25 million (1.3% of total capital)

- Jobs: 1,759

- Investment Type: Primarily local (5 projects) and JVs (3 projects).

8. Financial Institutions:

- Projects: 1

- Capital: $45.10 million (1.5% of total capital)

- Jobs: 28

- Investment Type: Joint venture (1 project).

9. Agriculture:

- Projects: 27

- Capital: $51.57 million (1.7% of total capital)

- Jobs: 78,779

- Investment Type: Balanced between foreign (14 projects) and local (9 projects), with some JVs (4 projects).

10. Economic Infrastructure:

- Projects: 4

- Capital: $34.22 million (1.1% of total capital)

- Jobs: 434

- Investment Type: Equally foreign (2 projects) and JVs (2 projects).

- Projects: 4

- Capital: $5.89 million (0.2% of total capital)

- Jobs: 71

- Investment Type: Equally foreign (1 project) and JVs (2 projects).

12. Telecommunication:

- Projects: 2

- Capital: $1.33 million (0.04% of total capital)

- Jobs: 59

- Investment Type: Predominantly foreign (1 project).

Investment Composition

Joint Ventures: Included 59 projects, reflecting collaborative efforts between local and foreign entities.

Foreign Investments: Accounted for 185 projects, highlighting strong international interest in Tanzania’s investment opportunities.

Local Investments: Comprised of 165 projects, demonstrating robust domestic participation.

July 2023 to June 2024 Performance

For the period from July 2023 to June 2024, TIC reported significant growth with 707 registered projects totaling $6,561.09 million in capital investment and creating 226,585 jobs.

This represents a notable increase from the previous year, with a rise in project registrations by 81.90% and a 73.61% increase in capital investment.

The manufacturing sector was the most active, with 313 projects and a capital investment of $2,462.63 million, resulting in 41,112 jobs. The agriculture sector, with 56 projects, created the highest number of jobs at 103,453, despite a capital investment of $710.02 million. Other significant sectors included commercial building, with 76 projects and $1,079.09 million in capital, and transportation, with 128 projects and $1,035.46 million in capital.

The Tanzania Investment Centre (TIC) reported significant growth in the 2023-2024 financial year, with 707 registered projects totaling $6,561.09 million in capital investment and creating 226,585 jobs. This represents a notable increase from the previous year, with a rise in project registrations by 81.90% and a 73.61% increase in capital investment.

Key Highlights

- Investment Types:

- 38.1% local ownership

- 28.8% foreign ownership

- 13.8% joint ventures

- Sectoral Leaders:

- Manufacturing: 313 projects, $2,462.63 million

- Transportation: 128 projects, $1,035.46 million

- Agriculture: 56 projects, $710.02 million

- Energy: 8 projects, $118.49 million

- Tourism: 75 projects, $349.40 million

2019/20 to 2023/24 Performances

Analyzing the data from the financial years 2019/20 to 2023/24, there has been a consistent upward trend in investment activities in Tanzania.

The number of registered projects increased from 220 in 2019/20 to 707 in 2023/24, while capital investment grew from $1,736.95 million to $6,561.09 million.

Job creation also saw a significant rise, from 31,825 jobs in 2019/20 to 226,585 jobs in 2023/24.

The manufacturing sector has consistently been a major contributor, while sectors like agriculture and transportation have also shown substantial growth in recent years.

Commenting on these results, TIC Executive Director, Gilead Teri, emphasized the government’s commitment to improving the investment environment through policy reforms and automation.

The center has introduced fast services through the Premier Service Centre, where investors can receive assistance with permits and registration within 24 hours. This one-stop service has enabled TIC to collaborate closely with 12 institutions responsible for issuing permits and licenses to investors.

Furthermore, TIC has established the Tanzania Electronic Investment Window (TelW), an electronic system that has significantly facilitated investment processes. This system allows investors to register projects and submit applications from anywhere in the world.

These initiatives have led to a substantial increase in registered projects, reflecting Tanzania’s dedication to fostering a favorable investment climate and attracting both local and international investors.

National Campaign to Promote Domestic Investment

To further support investment, TIC has launched campaigns aimed at promoting domestic participation and changing the perception that investment is solely for foreign nationals.

These campaigns focus on providing investment education, particularly about the procedures for registering various projects. Additionally, they seek to raise awareness of the benefits, including tax and non-tax incentives available through the Certificate of Incentives issued by TIC.

The main campaign, “Jenga Taifa Letu” (Build Our Nation), was launched by Prime Minister Kassim Majaliwa on September 25, 2023.

The first phase of the campaign covered 17 regions of Tanzania, namely: Mwanza, Geita, Shinyanga, Tabora, Singida, Manyara, Arusha, Kilimanjaro, Tanga, Pwani, Morogoro, Dodoma, Iringa, Njombe, Mbeya, Songwe, and Mtwara.

The second phase aims to reach the regions of Kagera, Mwanza, Mara, Simiyu, Lindi, Ruvuma, Rukwa, Katavi, and Kigoma.